Supply and Distribution

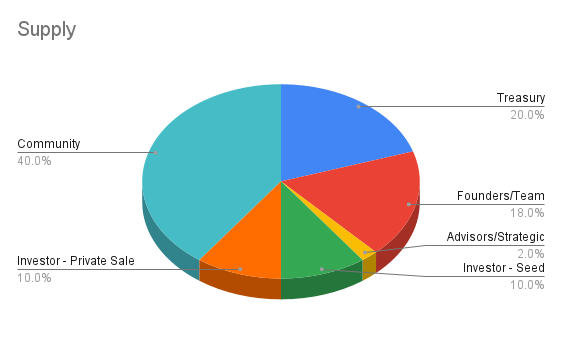

The Kyōdō Token (KYD) acts as a governance token, allowing its holders to vote on future updates. Token distribution will occur in phases, including public and private sales, allocations to founders, seed investors, project treasury, strategic YouTube influencers, as well as airdrops and bounties. See below:

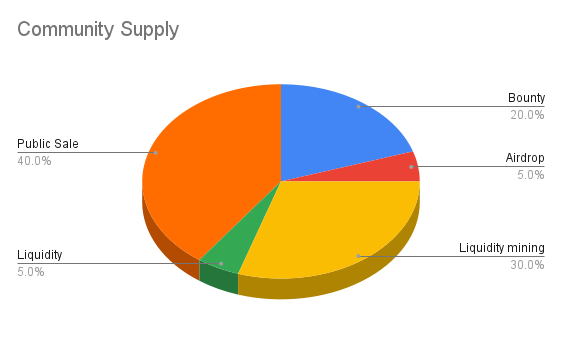

"Community" here means the segment of the total supply of KYD Tokens that will be accessible for community members to purchase. This amounts to 40% of the total supply, or 40 million KYD tokens. This part will be divided among different initiatives such as bounties, airdrops, liquidity mining, liquidity provision, and public sales:

Let's delve into the meaning of each of these terms. Refer to the Table of Contents for easy navigation.

Table of Contents

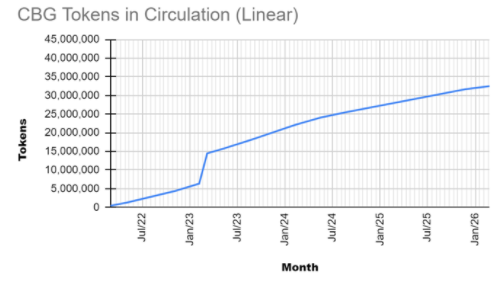

Circulating Supply

The current circulating supply stands at 30 million KYD tokens, out of a total max supply of 100 million. These tokens will hit the market unevenly across a period of 48 months, with some being subject to a year-long lock-up period.

Treasury (20%)

The DAO Treasury will hold 20% of the total supply of KYD tokens. This treasury is set to grow as new fees are collected. Each month, the DAO treasury will use these fees to purchase more tokens.

The Kyōdō DAO community decides through votes what to do with the treasury, such as establishing partnerships or liquidity programs.

During the initial year, these tokens will be subject to a lock-up period.

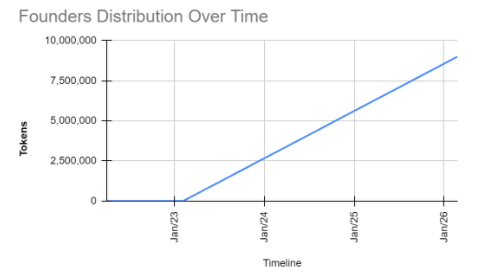

Founders/Team (18%)

The team and founders behind Kyōdō will receive 18 million KYD tokens. These will be locked for a year and, subsequently, will be gradually distributed over the next 36 months, as illustrated in the following graph.

It should be noted that an internal policy will be implemented to determine the allocation of KYD tokens to team members. This policy will take into account factors such as the length of their tenure on the team to determine the appropriate amount of tokens they will receive.

Seed (10%)

A total of 10% of the supply, corresponding to 10 million KYD tokens, will be allocated for the seed investment round. Funds raised through this sale will be used to further develop the Kyōdō Protocol.

Each KYD token will be priced at $0.08 for investors, projecting a fundraising target of $800,000 for the Kyōdō Protocol. This presents the most advantageous buying opportunity for potential KYD token holders. While these tokens are not subject to any lockout period, they will be disbursed over a period of 12 months.

Private Sale (10%)

Another 10 million KYD tokens are slated for a private sale, with each token priced at $0.24. Similar to the seed round, there will not be a lockout period for these tokens. However, they will roll out gradually over a 36-month period.

Proceeds from this sale will also be channeled towards the development of the Kyōdō Protocol. This includes expanding the team with new hires and ramping up marketing efforts.

Strategic Advisors (2%)

A pool of 2 million KYD tokens will be specifically reserved for a select group of strategic advisors. These individuals will play crucial roles in testing the platform and driving its adoption. While these tokens are subject to a one-year lockout period, they will be rolled out progressively to advisors over the 24 months following the lockout.

Community (40%)

Public Sale (16%)

A total amount of 16 million KYD tokens, representing 16% of the allocation, will be made available to the public for purchase on decentralized exchanges or other platforms.

At this stage, the circulating supply of KYD tokens will be 36 million.

Liquidity Mining (12%)

12 million KYD tokens, representing 12% of the allocation, will be rewarded to those who contribute to KYD liquidity through a dedicated liquidity program. Contributors who provide more liquidity for a longer period will receive a larger share of the KYD pool.

Bounties and Quests (8%)

8 million KYD tokens, or 8% of the allocation, will be used for bounty rewards. These bounties are for Community Managers who recruit other Community Managers.

The distribution of these tokens will be phased. In phase one, 2.5% (or 2.5 million KYD) will be allocated, with each recruited Community Manager receiving 200 KYD and the referrer receiving 100 KYD.

In the second phase, 1.5% (or 1.5 million KYD) will be allocated, with each recruited Community Manager getting 100 KYD and the referrer getting 50 KYD.

In the third phase, 1% (or 1 million KYD) of the tokens will be allocated, with 50 KYD going to the recruited Community Manager and 20 KYD to the referrer. All these tokens will be locked for a year.

Additionally, 3% (or 3 million KYD) will be allocated for Quests, with tokens distributed to community members who complete them. More information about these Quests will be released in due course.

Liquidity (2%)

After the Public Sales, Kyōdō DAO will initially provide liquidity of 2 million KYD tokens, which is 2% of the allocation.

Airdrops (2%)

Kyōdō DAO will allocate 2 million KYD tokens (or 2% of the allocation) for airdrops to community members who actively promote the Kyōdō Protocol, interact with others, and early users of the platform. Specific eligibility criteria for these airdrops will be provided in the future.